- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

In international trade,Export Drawbackservice company, we combine practical experience and legal norms to provide professional advice to foreign - trade enterprises from the perspectives of liability determination and risk prevention.foreign tradeI. Common Causes and Impacts of the Loss of Export Tax Refund DocumentsA complete export agency agreement should be attached with:II. Legal and Contractual Bases for Liability DeterminationExport RepresentationIII. Difficulties and Countermeasures in Liability Determination in Practice

IV. Risk Prevention Suggestions

1.Errors in the Agency Link

- : The agency company fails to transfer documents in a timely manner or fails to fulfill its custody obligation.: Third - Party Liability

- : Logistics companies, customs brokers, or tax authorities lose documents during the transfer process.: Force Majeure Factors

- : Natural disasters, transportation accidents, etc. lead to the damage of documents.: Consequences of Document Loss

- The tax refund application is rejected by the tax authorities, and the direct economic loss can reach 13% - 17% of the tax refund amount.: It affects the enterprises export credit rating and increases the risk of subsequent business supervision and review.

2.If document forgery or repeated tax refund is involved, it may trigger administrative penalties or even criminal liability.

- Liability Division at the Legal Level

- Provisions of the Entrustment Contract in the Civil Code

- : As the trustee, the agency company needs to fulfill the duty of careful custody. If the documents are lost due to intentional or gross negligence, it needs to bear the liability for compensation.

Typical Scenarios of Document Loss

1.Announcement of the State Taxation Administration on Issues Concerning the Declaration of Export Tax Refund (Exemption)

- : It is clear that enterprises are responsible for the authenticity and integrity of the documents, but they can prove third - party liability to reduce their own obligations.: Key Clauses of the Agency Service Contract

- Custody Liability Clause: Clearly define the document handover time, custody method, and remedial measures after loss.

2.Agreement on Exemptible Circumstances

- : For example, the agency can be exempted from liability if the loss is caused by the clients delay in providing information or force majeure.: Clause on the Upper Limit of Compensation

- : The agency company usually agrees that the service fee is the upper limit of compensation, and the part exceeding it needs to be covered by commercial insurance.: Allocation of Burden of Proof

- Clause on the upper limit of compensation: Agent companies usually agree that the service fee is the upper limit of compensation, and the amount exceeding this needs to be covered by commercial insurance.

Internal Management Oversight of Enterprises

1.Allocation of burden of proof

- Enterprises need to prove that there is a direct causal relationship between the loss of documents and the fault of the agent, such as providing evidence chains like handover records and communication emails.

- The agency company can prove its innocence by signing the Document Handover Confirmation and using a digital management system to leave traces.

2.Feasibility of Remedial Measures

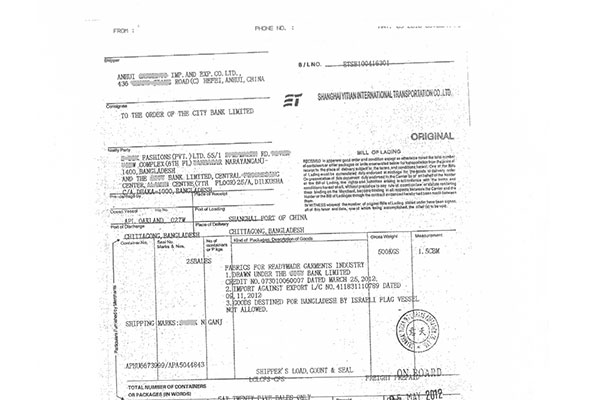

- Customs documents such as the customs declaration form can be applied for re - issue from the customs, but the cycle is as long as 1 - 3 months and a handling fee needs to be paid.

- If a VAT invoice is lost, it needs to be reported as lost to the tax authorities and a public notice should be placed in the newspaper, which may affect the timeliness of tax rebates.

: Loss occurs due to the lack of a document filing system or non - standard handover procedures.

1.Enterprise - side Prevention and Control Measures

- Establish an electronic backup system for documents (such as scanning and archiving to the cloud) to achieve dual - track management of physical and digital documents.

- In the contract signed with the agency company, clarify the responsibility for document storage, the handover process, and the standards for breach of contract compensation.

- Insure against export credit insurance or special insurance for document loss to transfer potential risks.

2.Value of Choosing Professional Agency Services

- Systematic Management Ability: Regular agency companies use the ERP system to track the transfer nodes of documents and issue real - time warnings for abnormalities.

- Legal Risk Avoidance: The agent can reduce the probability of loss by pre - examining the compliance of documents and promptly following up on the customs declaration progress.

- Emergency Handling Experience: A professional team can assist enterprises in quickly re - applying for documents or striving for tax rebate rights through administrative reconsideration.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912