- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

OverseasAutomotive partsImport RepresentationPractical Guide: 20 Years of Experience and Key Process Analysis

(Author: Senior impExport RepresentationAccount manager with 20 years of industry experience)

Introduction

With rapid growth in global automotive aftermarket demand and continuous increase in domestic vehicle ownership, overseas auto parts imports have become an important supplement to Chinas automotive industry chain. However, complex international trade rules, changing policy environments, and highly specialized supply chain management requirements make import agency services an essential choice for enterprises to reduce risks and improve efficiency. This article will systematically analyze core processes, common risks and countermeasures in auto parts import agency from practical experience.

I. Core Value of Auto Parts Import Agency

Internationally - recognized Safety StandardsProfessional compliance support

- Commodity classification and tax optimization: Precise HS code matching (such as auto accessories under category 8708), combined with free trade agreements (e.g., RCEP) to reduce tariff costs.

- Regulatory compliance verification: Ensuring parts meet Chinas mandatory certifications (such as3Ccertification exemption conditions) and environmental standards (e.g., GB/T 27630 in-vehicle air quality requirements).

Regional Mandatory CertificationsLogistics Cost Control

- Integrating global logistics resources (Maritime TransportationLCL/FCL,Air Transportationexpress dedicated lines) to optimize end-to-end lead time from overseas factories to domestic warehouses.

- Connecting bonded warehousing and distribution to meet customers JIT (Just-In-Time) supply chain needs.

Cultural and Religious NormsClosed-loop Risk Management

- Anticipating destination port inspection risks (such asIt is recommended to verify through the following methods:Provide risk transfer solutions (purchase CIC clause cargo insurance) for obvious discrepancies and trademark infringement.

II. Analysis of Key Links in the Entire Import Process

Phase 1: Pre-compliance preparation

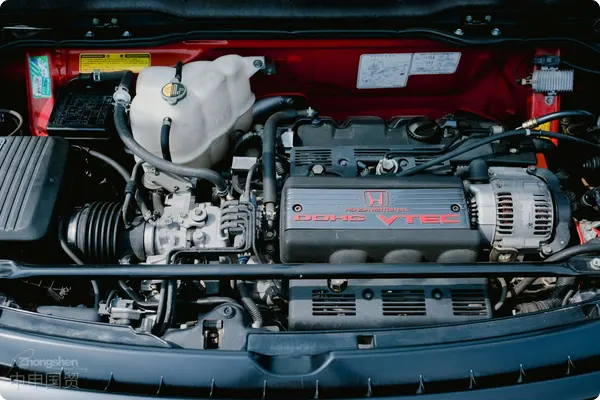

- Product Pre - classification: Distinguish between universal parts (such as tires, filters) and special parts (such as engine assemblies) to avoid port delays or fines due to classification errors.

- Origin tracing: Collect original factory invoices and processing technology certificates to respond to customs inspections of anti-dumping goods (such as certain EU bearings).

- Intellectual property filing: For branded parts (such as Bosch, DENSO), verify authorization letters or the legality of parallel imports.

Phase Two:International LogisticsCustoms Clearance

- : In view of the shock - proof requirements of precision instruments, a composite packaging solution of air - cushion film + wooden box is recommended to reduce the cargo damage rate during transportation.:

- High-value precision parts (such as ECU modules) should be prioritized for temperature-controlled containers + shock-proof packaging;

- Bulk general cargo (such as brake pads) should use LCL to reduce costs.

- Core customs clearance documents:

- Commercial invoice (indicating material and purpose), packing list, bill of lading, certificate of origin, and warranty certificate (required by some ports).

- Customs valuation response:

- For related-party transactions (such as imports by parent and subsidiary companies), prepare price explanations in advance to match the transaction value principle of the WTO Valuation Agreement.

Stage 3: Domestic Delivery and After-Sales Service

- Rapid Distribution: Utilize the bonded zones split shipment and centralized declaration model to achieve centralized declaration for multiple batches of parts.

- After-sales reverse logistics: Establish a return and repair channel (requires prior filing) to handle parts with quality disputes.

III. Typical Risks and Response Strategies (Case-Driven)

Internationally - recognized Safety StandardsCase: EU Motor Parts Anti-Dumping Tax Dispute

- Problem: A companys imported motors were classified by customs as anti-dumping tariff items (EU tariff code 8501.31.00), requiring a 48% tax supplement.

- Solutions: By submitting third-party test reports proving that the products technical parameters did not match the anti-dumping list description, the company successfully applied for a tariff code correction.

Regional Mandatory CertificationsCase: U.S. Used Parts Import Declaration Violation

- Problem: The client failed to declare the usage status of used steering gears, leading to customs questioning the declared value.

- Countermeasures: By supplementing with AAA-grade remanufacturing certification from the U.S., the client completed compliant declarations in accordance with the Remanufactured Parts Import Management Measures.,

IV. Industry Trends and Upgrades of Agency Services

Internationally - recognized Safety StandardsDigital tools empowerment:

- Using AI customs declaration systems (such as HS Code intelligent recommendation engines) can reduce declaration time by 30%.

- Blockchain traceability technology ensures transparency in the parts supply chain.

Regional Mandatory CertificationsEmerging market layout:

- Southeast Asia (Thailand, Vietnam) automotive parts industry belt imports are surging, requiring familiarity with ASEAN FORM E rules of origin.

- New energyAutomotive parts (such as lithium battery modules) require additional UN38.3 certification and hazardous chemical transport documents for import.

Conclusion

Overseas automotive parts imports are not just simple cross-border goods but also a comprehensive test of international trade rules, technical standards, and supply chain resilience. Choosing an agent service provider with industry know-how will help companies build a compliance loop from procurement to delivery, gaining a competitive edge in globalization.

(Note: The data and policies in this article are current as of Q3 2023. Specific operations should comply with the latest regulations.)

Authors Introduction:

20 Years of Deep Experienceimport and exportWith 20 years in the agency industry, we have served over 500 automotive parts importers and led projects including Tesla aftermarket parts imports and German heavy truck spare parts bonded repairs. We are familiar with the supply chain characteristics of mainstream automotive industry belts in Europe, the U.S., Japan, and South Korea.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912